Excel How To

Discover how to use Excel to compute NPV, or net present value.

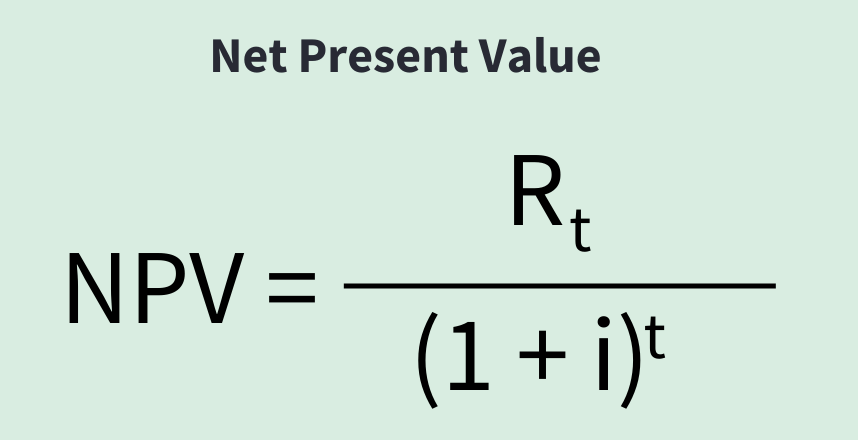

A financial calculation called NPV (Net Present Value) is used to discount future cash flows.

To determine if an investment will be profitable in the future, a calculation is made.

Remember that money is never truly worth what it was yesterday or today.

We devalue the future cash flows as a result.

If the funds were not used for this project, what other use could you make of them?

The Formula:

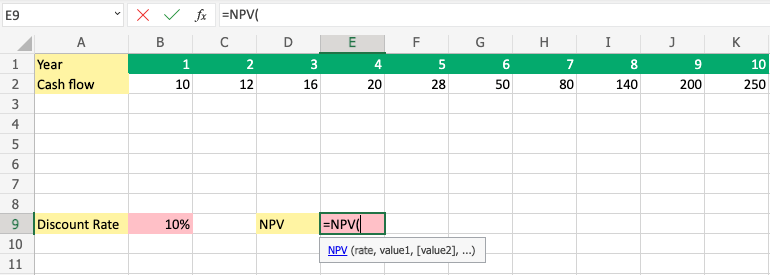

Step 1) make a sheet and enter values.

We will compute the NPV over a 10 year period in this case.

The 10% discount rate is the return of necessity.

To follow the example, copy the values.

Copy and paste the values into your spreadsheet.

If you want it to look more put together, you have to do the styling yourself.

Make sure the input in cell B9 is 10% (percentage) rather than merely 10.

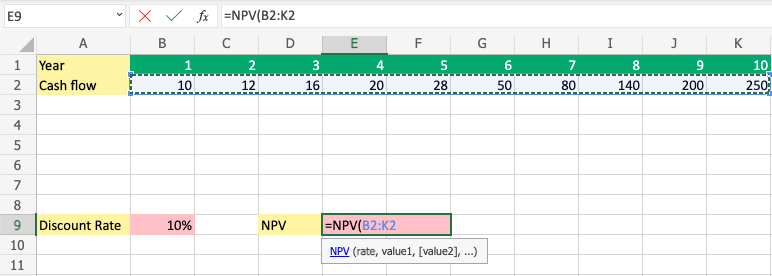

Step 2) Start the NPV Function:

Step 3) Enter NPV Values:

Note: A symbol, such as a comma or semicolon, is used to separate the various components of the function;

The symbol is determined by your language preferences.

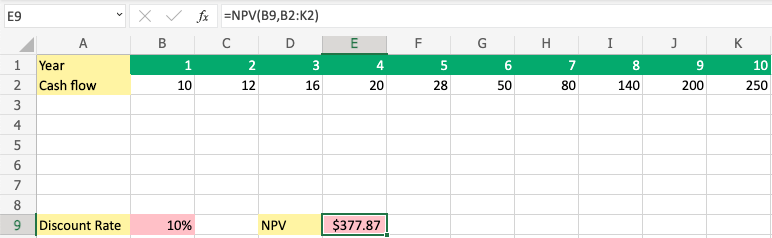

Well done!

You have effectively used a 10% discount rate and computed the net present value (NPV) over a ten-year period.

The correct response in this instance was 377,87.

CodingAsk.com is designed for learning and practice. Examples may be made simpler to aid understanding. Tutorials, references, and examples are regularly checked for mistakes, but we cannot guarantee complete accuracy. By using CodingAsk.com, you agree to our terms of use, cookie, and privacy policy.

Copyright 2010-2024 by Refsnes Data. All Rights Reserved.